In my last post from September 2013, I noted that housing prices were once again increasing. At the time, I thought Vancouverites were rushing to get into the market before rates increased. But price increases have now continued for over a year and a half, so it seems clear that was not the reason. As I continued to watch the market, I tried to look for a better explanation. Other than the usual housing bubble rationalizations — everyone wants to live here, we’re running out of land, etc. — the conventional wisdom for recent gains seemed to be low interest rates. But even with historically low rates, housing affordability was already near record lows. It doesn’t seem plausible that already-strained households have been able to keep the party going for so long. A market driven by low mortgage rates should look more like this:

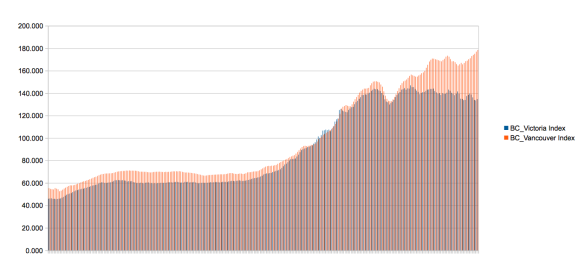

A market driven by low mortgage rates should look more like this:  I also noticed a clear disconnect between the first phase of the bubble (2002-2008) and the second phase (2009-present). During the first phase, all of the Canadian bubble markets increased in a similar fashion. As an example, compare the price history of Victoria and Vancouver.

I also noticed a clear disconnect between the first phase of the bubble (2002-2008) and the second phase (2009-present). During the first phase, all of the Canadian bubble markets increased in a similar fashion. As an example, compare the price history of Victoria and Vancouver.  The first peak occurred in mid-2008. Up until then, both markets moved together. But after the initial recovery in 2009, Vancouver began to behave differently than Victoria and other Canadian markets. Over the last 5-6 years, something very different has been going on here. In my opinion, the difference has been foreign buying — mostly from Mainland China. Unfortunately, there is no hard data on the amount of foreign ownership, so I’ve had to base my opinion on the excellent work of Ian Young, Andy Yan and others.

The first peak occurred in mid-2008. Up until then, both markets moved together. But after the initial recovery in 2009, Vancouver began to behave differently than Victoria and other Canadian markets. Over the last 5-6 years, something very different has been going on here. In my opinion, the difference has been foreign buying — mostly from Mainland China. Unfortunately, there is no hard data on the amount of foreign ownership, so I’ve had to base my opinion on the excellent work of Ian Young, Andy Yan and others.

But after years of listening to claims that foreign buying is too insignificant to drive a market as big as Vancouver, I think I’ve found definitive proof. When housing markets are driven by easy financing and low mortgage rates, appreciation is higher for low-end, entry-level homes than it is for more expensive homes. Entry-level buyers are much more likely to max-out on debt than older, wealthier homeowners. This was the case in US bubble markets. For example, look at San Diego. Low-priced homes increased much more than high-priced properties.  This was also true during the first phase of the Vancouver bubble. Here is a scatter plot generated from the April 2009 REBGV Stats Package, showing 5-year appreciation by price. It’s clear that lower priced properties appreciated more.

This was also true during the first phase of the Vancouver bubble. Here is a scatter plot generated from the April 2009 REBGV Stats Package, showing 5-year appreciation by price. It’s clear that lower priced properties appreciated more.

I then created the same plot using data from the most recent Stats Package, and the results are pretty startling. High-priced homes have appreciated much more than less expensive properties over the last 5 years.

I can’t think of any realistic scenario where local Vancouverites were able to send this bubble into overdrive with the help of lower mortgage rates — especially when you consider CMHC no longer insures mortgages on homes sold for more than $1 million. The only plausible reason I have been able to come up with is a massive influx of offshore wealth.

Update: Not everyone is familiar with scatter plots, so here are the MLS HPI graphs from the Real Estate Board. As in the scatter plots, these graphs confirm (lower priced) condos appreciated more before 2008, and (higher priced) single family homes have appreciated more in recent years.

Ownership cost would only fall as a percentage of income if property prices stayed constant. If price increase kept pace with rate decrease then the ownership cost would stay roughly the same.

However, in a bubble, people tend to buy bigger and more expensive and use more leverage for more gains as prices increases at an increasing pace (dollar or percentage wise). So I would say what you found indicates presence of a bubble more than foreign ownership.

After all, if you are convinced that price increase will continue, would you invest smaller amount of money into cheaper properties? Or more likely borrow your brains out and buy the biggest and most expensive property you can get for more gains?

A bubble is simply when the price of an asset class rises significantly above its fundamental value. What I’m trying to determine is the cause of the bubble.

As I mentioned in the post, most housing bubbles — and the first phase of the Vancouver bubble — are driven by entry-level buyers taking on higher and higher levels of debt. That’s why lower-priced homes usually appreciate more during a bubble.

The fact phase two of the Vancouver bubble is behaving completely different is what I think proves foreign wealth is now the driver.

Welcome back

Thanks. Just wish it was under better circumstances!

If you mean high prices are only affordable by those with high NW or incomes, yes there is probably some foreign buying going on at the high end. I am not seeing that percolate significantly region-wide, leading me to conclude that a market as large as Vancouver’s is capable of meeting the demand for housing.

It is a bit of everything in the mix. Foreign capital is definitely part of it. As are low rates, basement suites and laneway houses, renovations, density speculation, population growth, demographics, and plain old fear.

Don’t get me wrong, I hate outsiders as much as anyone but Vancouver as a region still has lots of places to expand. Just perhaps not in the areas people aspire to live in.

Do you have any other explanation for the recent high-end activity? Where is all that wealth coming from? Is there some new, fast-growing, high-paying industry that I’m unaware of?

There might not be any foreign buying going on in Langley, but here on the West Side, it is very significant and so is the percolation.

Did San Diego only run out of land in the places people didn’t aspire to live in?

This seems like skirting around the issue.

A more basic question;

Are we to believe there is enough locally generated wealth/income to justify the run up in prices in areas that statistically seem to be galaxies away from reach by documented incomes?

And if the answer is “yes.” What areas of the economy are generating the necessary wealth/income to continue the price growth?

Cheers,

Burt

Vancouver houses are used for growops….

grow ops hurt home values, not help them.

Welcome back Michael.

Welcome back Michael. It’s been awhile, I’ve been waiting for the market to correct since 2012. So far I have been absolutely wrong and all my friends and family just shake their head on why I didn’t buy a detached house sooner. Now I have 2 kids and renting. Soon I will throw in the towel and going to buy a house, even though I believe prices will go down once interest rates rise. I have a personal deadline of end of this year. But I simply don’t care anymore, I’m getting old and just want to own a detached house.

Pingback: Vancouver Flippers In Trouble | Is Supply The Problem?

Pingback: How Much More Proof Do We Need? | Vancouver Housing Blog