One of the favourite justifications for high housing prices in Vancouver is, “we’re cheap compared to other world-class cities like Paris, Tokyo, London, New York, etc.”. In fact, Housing Minister Rich Coleman (following up on his comments from last week) gave this response a few days ago when asked about foreign ownership in Vancouver.

“I believe that the market place adjusts. If you notice over the years, it has fluctuations up and fluctuations down. If you look at the mean cost of housing across British Columbia and you compare it to other major cities worldwide, the reason it is attractive internationally is because it’s actually pretty reasonable compared to other cities like London, Singapore, Tokyo”

But is Vancouver really comparable to those cities?

Population

How does Vancouver compare to those other cities when it comes to metropolitan area population?

- Tokyo: 34,607,069

- New York: 20,092,883

- London: 13,879,757

- Paris: 11,978,363

- Western Canada: 10,394,228 (west of Ontario)

- Pittsburgh: 2,356,285

- Vancouver: 2,313,328

- Portland: 2,226,009

When it comes to population, Vancouver is not even close to the usual comparison cities. In fact, Tokyo, New York, London and Paris all have higher populations than Western Canada. On the list of North American Metropolitan Areas, Vancouver ranks 35th — right between Pittsburgh and Portland.

World City Rankings

The Globalization and World Cities Research Network has a methodology for ranking world cities. In their most recent analysis, the top four cities were: London, New York, Hong Kong and Paris. Vancouver ranks more than 60 places lower, most comparable to: Caracas, Riyadh, Chennai and Manchester.

A.T. Kearney compiles a Global Cities Index (GCI), which “examines a comprehensive list of 84 cities on every continent, measuring how globally engaged they are across 26 metrics in five dimensions: business activity, human capital, information exchange, cultural experience, and political engagement”. The usual comparison cities are all at the top. Vancouver ranked 48th.

The 3 most visited museums in the world are in Paris, New York and London. The Vancouver art gallery didn’t make the top 100.

Of the four major cross-border North American sports leagues (MLB, NBA, NHL, MLS), Vancouver has 2 teams and 0 championships. New York has 8 teams and 41 championships. Vancouver briefly had an NBA franchise, but lost it to fellow world-class city Memphis, Tennessee.

New York has Broadway, London has the West End, Vancouver has Granville Street?

Reasonable Comparisons

Vancouver is simply not in the same league as the truly world-class cities with which it is often compared. Two much more comparable cities are Portland and Seattle (similar populations, weather, natural beauty, etc.). So, how do these three cities compare when it comes to median house prices?

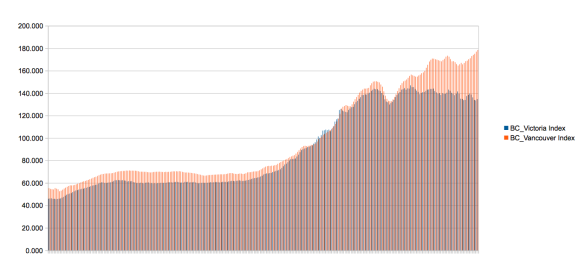

- Vancouver: $704,800 CAD

- Seattle: $359,100 USD

- Portland: $291,300 USD

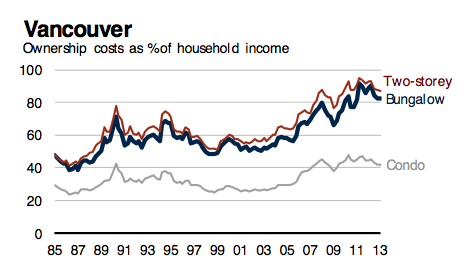

Sure, Vancouver is cheaper than truly world-class cities. But compared to similar cities, it is extremely overpriced.