As I pointed out last month, the biggest obstacle to residential development isn’t the mountains, ocean or US border — it’s the Agricultural Land Reserve (ALR). To illustrate the point, let’s take a detailed look at the City of Richmond.

Here is an aerial shot of the city, where you can see that about 40% of the total available land has been dedicated to agricultural uses.

And even though the population of Richmond has increased by about 75,000 since 1989, the ALR within the city has actually increased slightly since then.

Since the early 1970s when the ALR was created, the population of Metro Vancouver has more than doubled, and the average detached home has increased more than ten-fold! What started out as a good idea, is now creating more problems than it solves.

Since the early 1970s when the ALR was created, the population of Metro Vancouver has more than doubled, and the average detached home has increased more than ten-fold! What started out as a good idea, is now creating more problems than it solves.

Inefficient Land Use

There are approximately 211 farms operating on 3,072 hectares in Richmond. As of 2011, they were producing $48.6 million annually.

Considering that fifteen standard single family homes can be built per hectare, each standard single family lot in the ALR is currently generating about $1,055 worth of crops per year — which probably translates into $200 of profit. When you further consider that the standard lot in Richmond is currently assessed in the neighbourhood of $800k, the effective yield on ALR land is only about 0.025%. Not a very efficient use of a precious resource!

Lost Property Tax Revenue

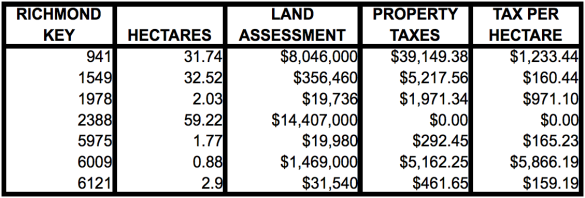

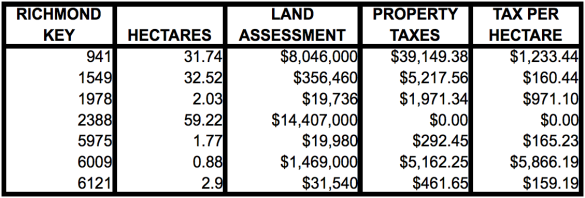

Property taxes on agricultural land vary considerably depending on parcel size and use. Here is a sample of seven randomly chosen parcels within the ALR:

Property taxes for agricultural land are significantly lower than they are for residential properties. Taxes generated from this (admittedly small) sample average $398/ha.

The average residential property is taxed at about $50,000/ha. Building houses on this land instead of growing crops could potentially generate an additional $150 million per year in tax revenue for the city.

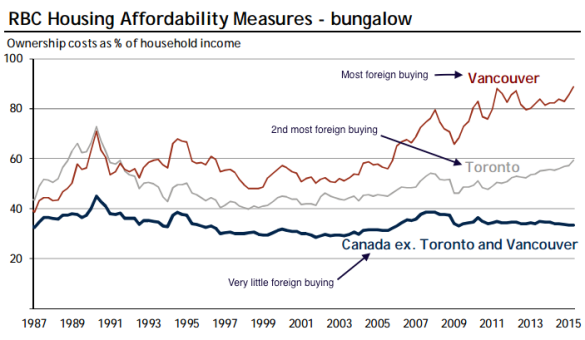

Inflated House Prices

Of course, the biggest drawback of reserving so much land in the middle of the third biggest metropolitan area in Canada is inflated house prices. The median priced detached home in Richmond has now reached $1,155,500. More than $800k of that cost is just for the land. If the ALR wasn’t restricting development so much, a Richmond lot would cost several hundred thousand dollars less.

In 2014, there were 1,692 detached home sales. Opening up just half of the ALR in Richmond to residential development would be enough to build over 30,000 detached homes — almost 18 years worth at current sales rates.

And to anyone concerned that the loss of 2,500 hectares of ALR will damage our ability to feed ourselves, don’t worry. This is only 0.053% of the 4,700,000 hectares currently in BC’s ALR.

Time To Re-evaluate

The housing crisis in the Lower Mainland has reached a point where serious changes will need to be made. Since we are unable to affect interest rates — and the government seems unwilling to address foreign capital flooding into the region — it just might be time to re-evaluate the Agricultural Land Reserve.

Forcing families to fork out several hundred thousand dollars more for a home so we can grow $1,055 worth of blueberries instead doesn’t seem like the wisest course of action. And it certainly doesn’t put families first.